On the heels of another wild trading week in world markets, today one of the top economists in the world sent King World News an incredibly powerful piece warning that the world is now set to plunge into the most chaotic and destructive economic depression in history. Below is the fantastic piece from Michael Pento.

There can be no denying the fact that Japan seems trapped in an endless lost decade. Despite massive money printing and currency depreciation, the nation can’t seem to shake off its relationship with weak GDP. Likewise, with lackluster economic growth and disappointing data points rolling in every day, the United States appears trapped for eight years and counting in its own lost decade….

Shocking Differences Between Japan And The United States

In contrast, the US stock market is up nearly 200% since the lows of great recession. The real estate market in large metropolitan areas like Manhattan and San Francisco have never been stronger. Clearly, the Fed’s decision to immediately combat falling asset prices with QE in the U.S. helped to re-inflate stock and real estate markets. However, the only problem is that it did very little to spur on growth.

Perhaps QE was an employment story rather than a growth story? After all, the unemployment rate surged as high as 10.2% in October of 2009 and the Fed, diligently pursuing their employment mandate, deployed QE to bring unemployment down to 5.5%.

But interestingly enough, in the absence of QE the Japanese unemployment rate never went over 5% for the entire decade. In fact, way before the deployment of Premier Abe’s money printing and bond buying arrow, Japan enjoyed one of the lowest unemployment rates of the industrialized world. And this data point alone should dismiss the popular Keynesian canard that inflation rates and employment rates are inextricably connected.

Unfortunately for both countries, recent data doesn’t portend these lost decades are going to be found any time soon. In the United States, economists have been falling over themselves to downgrade first quarter GDP growth, but also stand ready to blame the weather with alacrity. Both the ADP and Non-Farm Payroll job reports recently disappointed, as the economy created 189,000 and 126k jobs in March respectively.

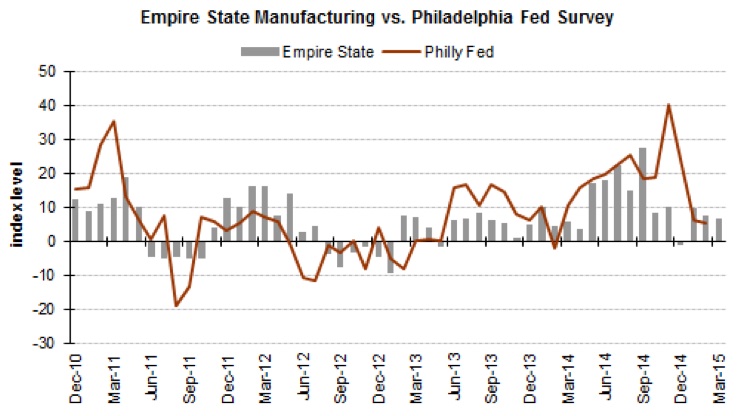

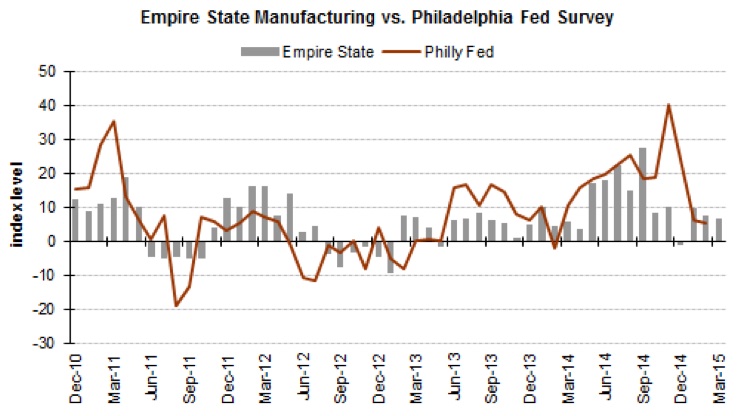

In addition to this, the pace of U.S. manufacturing growth fell in March to its slowest in almost two years, pressured by slowing gains in new orders and stagnant employment. In fact, after printing $3.7 trillion since the end of the Great Recession, U.S. GDP growth during 2014 (2.4%) was less than the growth (2.5%) experienced during 2010. There isn’t any evidence that QE helps the economy; but there’s plenty of anecdotes about money printing boosting asset prices.

Much the same thing has occurred In Japan, even after more than two years of Abenomics. Economists who had been expecting a 1.7% increase in output from the manufacturing sector from June were disappointed when preliminary government data suggested that production sank 1.2% in July. Manufacturers are now forecasting production to increase 0.1% in August, then fall 3.3% in September. GDP Growth rates in Japan and the U.S. don’t seem to be affected by the level of QE.

Is The United States Turning Japanese?

To answer the question: Are we turning Japanese? You could conclude that from a growth perspective we already are.

But more importantly, Japan sits as an interesting illustration of what the U.S. stock and real estate markets would look like if we hadn’t immediately engaged in QE. These markets would have contracted to a point that could be supported without the aid of government and central banks. In other words, permanently and genuinely healed.

But sadly, neither nation now embraces the function of free markets in setting asset values. It also establishes where the Fed’s newly coined money went. QE revolved around the carousel and canyons of Wall Street’s financial houses. But it never reached Main St. in the form of capital goods creation and full-time employment growth in the productive sector of the economy.

Bursting Debt Bubble To Cause Chaotic And Destructive Worldwide Depression

As the entire global economy sits mired in a lost decade, it is becoming clear QE failed to do anything but re-inflate old asset bubbles. But even much worse, it has created a massive new bubble in the global debt market. When this bubble bursts it will cause a worldwide depression.

Source:

http://kingworldnews.com/the-world-is-now-set-to-enter-the-most-chaotic-and-destructive-economic-depression-in-history/

marketing

There can be no denying the fact that Japan seems trapped in an endless lost decade. Despite massive money printing and currency depreciation, the nation can’t seem to shake off its relationship with weak GDP. Likewise, with lackluster economic growth and disappointing data points rolling in every day, the United States appears trapped for eight years and counting in its own lost decade….

Shocking Differences Between Japan And The United States

In contrast, the US stock market is up nearly 200% since the lows of great recession. The real estate market in large metropolitan areas like Manhattan and San Francisco have never been stronger. Clearly, the Fed’s decision to immediately combat falling asset prices with QE in the U.S. helped to re-inflate stock and real estate markets. However, the only problem is that it did very little to spur on growth.

Perhaps QE was an employment story rather than a growth story? After all, the unemployment rate surged as high as 10.2% in October of 2009 and the Fed, diligently pursuing their employment mandate, deployed QE to bring unemployment down to 5.5%.

But interestingly enough, in the absence of QE the Japanese unemployment rate never went over 5% for the entire decade. In fact, way before the deployment of Premier Abe’s money printing and bond buying arrow, Japan enjoyed one of the lowest unemployment rates of the industrialized world. And this data point alone should dismiss the popular Keynesian canard that inflation rates and employment rates are inextricably connected.

Unfortunately for both countries, recent data doesn’t portend these lost decades are going to be found any time soon. In the United States, economists have been falling over themselves to downgrade first quarter GDP growth, but also stand ready to blame the weather with alacrity. Both the ADP and Non-Farm Payroll job reports recently disappointed, as the economy created 189,000 and 126k jobs in March respectively.

In addition to this, the pace of U.S. manufacturing growth fell in March to its slowest in almost two years, pressured by slowing gains in new orders and stagnant employment. In fact, after printing $3.7 trillion since the end of the Great Recession, U.S. GDP growth during 2014 (2.4%) was less than the growth (2.5%) experienced during 2010. There isn’t any evidence that QE helps the economy; but there’s plenty of anecdotes about money printing boosting asset prices.

Much the same thing has occurred In Japan, even after more than two years of Abenomics. Economists who had been expecting a 1.7% increase in output from the manufacturing sector from June were disappointed when preliminary government data suggested that production sank 1.2% in July. Manufacturers are now forecasting production to increase 0.1% in August, then fall 3.3% in September. GDP Growth rates in Japan and the U.S. don’t seem to be affected by the level of QE.

Is The United States Turning Japanese?

To answer the question: Are we turning Japanese? You could conclude that from a growth perspective we already are.

But more importantly, Japan sits as an interesting illustration of what the U.S. stock and real estate markets would look like if we hadn’t immediately engaged in QE. These markets would have contracted to a point that could be supported without the aid of government and central banks. In other words, permanently and genuinely healed.

But sadly, neither nation now embraces the function of free markets in setting asset values. It also establishes where the Fed’s newly coined money went. QE revolved around the carousel and canyons of Wall Street’s financial houses. But it never reached Main St. in the form of capital goods creation and full-time employment growth in the productive sector of the economy.

Bursting Debt Bubble To Cause Chaotic And Destructive Worldwide Depression

As the entire global economy sits mired in a lost decade, it is becoming clear QE failed to do anything but re-inflate old asset bubbles. But even much worse, it has created a massive new bubble in the global debt market. When this bubble bursts it will cause a worldwide depression.

Source:

http://kingworldnews.com/the-world-is-now-set-to-enter-the-most-chaotic-and-destructive-economic-depression-in-history/

.jpg)

Post a Comment