The durability of the dollar isn’t a given, and pressure in the $12.3 trillion US Treasury market is causing alarm. A study by the Bank for International Settlements (BIS) suggests dollar dominance could spell disaster for emerging markets.

The spectacular recovery by the US dollar could ruin emerging market economies that have large dollar-denominated debts, which in turn could trigger chaos in the global financial markets, the Swiss-based global watchdog said.

“Should the US dollar - the dominant international currency - continue its ascent, this could expose currency and funding mismatches, by raising debt burdens,” Claudio Borio, Head of the Monetary and Economic Department at the BIS

The Bank for International Settlements, dubbed the bank for central bankers, warns of the imbalance between dollar debt and dollar output, and said it could have a “profound impact on the global economy.”

Cross-border dollar transactions have tripled to $9 trillion in the last decade, $7 trillion of which is outside of the US, according to the BIS. Companies in emerging markets have amassed $2.6 trillion in dollar-denominated debt.

“A long-standing puzzle in international finance is the durability of the dollar's share of foreign exchange reserves - which remains above 60 percent, while the weight of the US economy in global output has fallen to less than a quarter,” the report says.

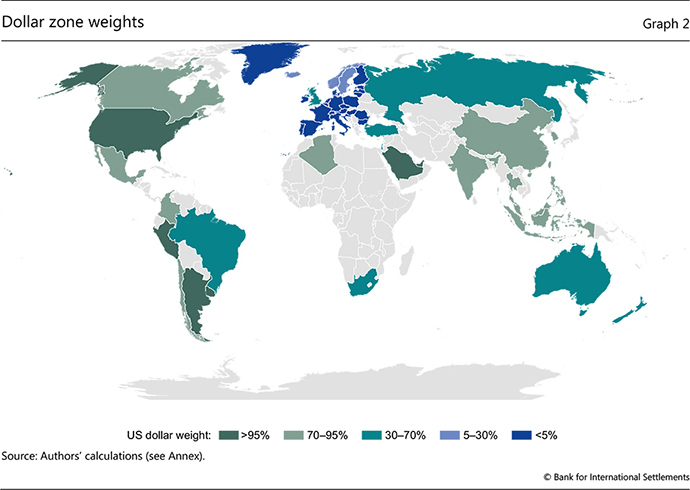

The study finds that the amount of dollar reserves a country decides to keep is directly correlated to the currency’s dollar weight, which they dub as the “dollar zone weight.”

“We find that the higher the co-movement of a given currency with the dollar, the higher the economy's dollar share of official reserves. Two thirds of the variation in the dollar share of foreign exchange reserves is related to the respective currency's dollar zone weight,” it says.

Among the biggest holders of reserves are emerging economies such as Brazil, South Korea, Hong Kong, Russia, Turkey, China, Saudi Arabia, Singapore, Mexico, Algeria, Thailand, and Taiwan.

Source:

http://rt.com/business/212351-dollar-dominance-risk-bis/

.jpg)

Post a Comment