Student debt reaches critical tipping point at $1.2 trillion as annual price increases enter the moment of truth.

The cost of going to college has come into deep questioning. In our inflation addicted market, the answer to every question regarding affordability involves more debt. Can’t afford a home? How about taking on a massive mortgage with a small down payment. Can’t afford a car? How about a 0 percent 0 down loan. Having trouble financing your college education? How about the albatross of student debt. It is no coincidence that student debt has fully gone off the rails courtesy of the federal government and banks dishing out student loans as if they were candy at Halloween. Is college worth the debt? In some cases it is and it also depends on what career you enter. This distinction is rarely made in the media where the general advice is “go to college and earn more” assuming all disciplines and schools are created equal (they are not). What about the predatory for-profit colleges that have horrific placement rates and high costs? What about going to a high cost private school and majoring in something that has little demand in the market? Yes college, is not a de facto employment training ground but at this price tag you better ask what you are getting for with that heavy debt burden. If we look at the low wage labor force, we have a market producing lower paying jobs and yet we continue to pump out more and more college graduates with heavier debt loads. Few will argue against education being a good thing. Of course education is important. However simply getting a degree does not equal financial success, or even getting a job in your field of study. The majority of this nation is financially in the dark when it comes to managing their finances or even understanding thedeep capture the financial sector has on government. For most, these questions never come up until they see the price tag of their college degree. Is college worth the price of debt?

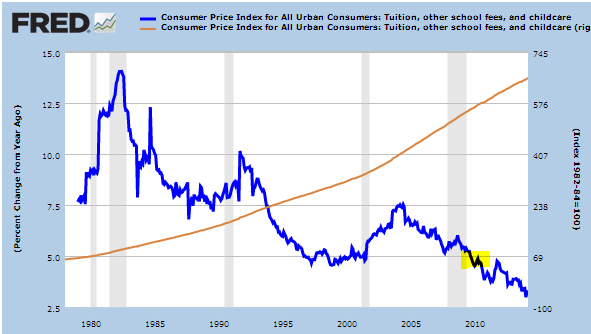

Tuition hitting maximum growth rate

The growth rate of tuition is simply a spectacle to behold. If this were a mutual fund, you could only hope that you had your funds in this account over the last generation. For the last decade, the cost of going to college has outpaced virtually every segment of our economy. The rate has been much higher than that of housing, healthcare, food, and energy. With incomes being stagnant after adjusting for inflation, many have to go into debt merely to afford their college education.

Take a look at tuition over the last generation:

The cost of going to college has gone up between 350 and 400 percent in the last generation. This depends on if we also look at for-profit costs, private schools, and public institutions. What you will notice in the chart above is that the annual increases are dropping much lower. We are reaching a tipping point on how much colleges can charge. Better put, we are reaching a saturation point as to how much debt students can take. Clearly most cannot afford the price without massive levels of debt.

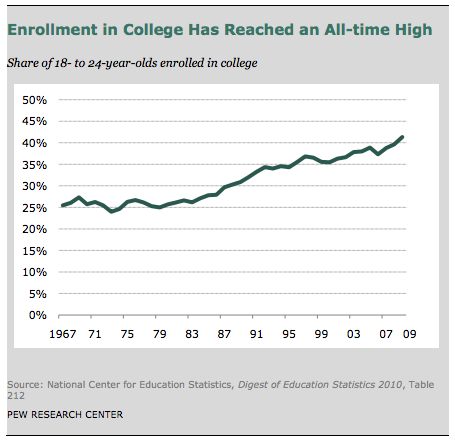

College to avoid workforce?

Never in the history of our country have we had so many people attending college:

From the 1960s to the early 1980s we had about 25 to 30 percent of our 18 to 24 year olds enrolled in college. All of this started expanding with the decimation of our blue collar workforce in place of our low wage economy. College in many cases is now the only road for most to enter into the shrinking middle class.

Yet this rise in enrollment doesn’t necessarily mean higher wages. Simply going to college is not going to get you a job that coincides with the level of debt you have taken on. In a previous generation, many went to affordable colleges and entered into a job market with good paying jobs. The cost of college was low and wages were high. Today, this paradigm is reversed. The market is flooded with low wage jobs yet the cost of going to college is high.

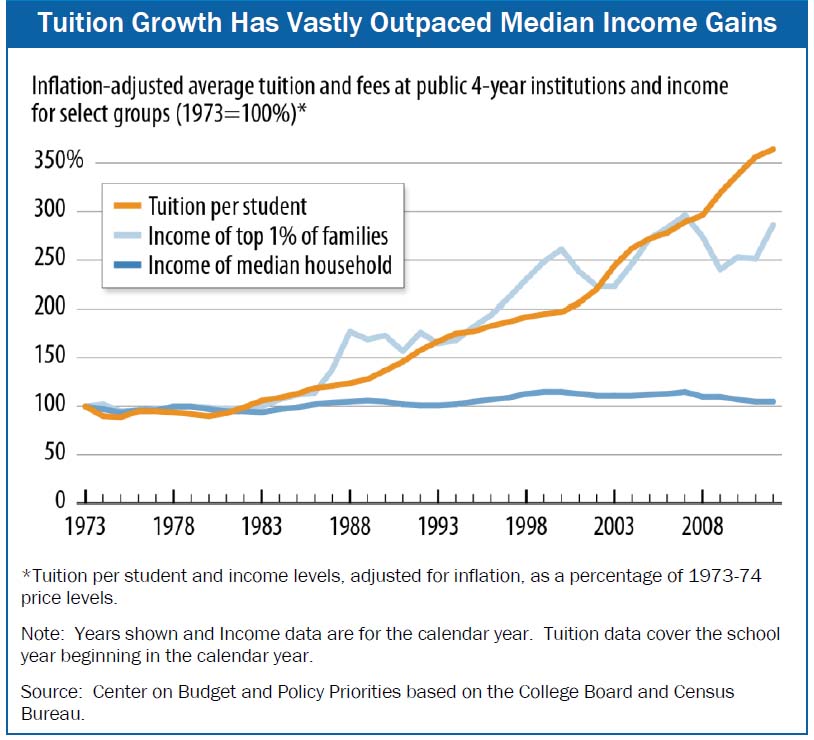

Income versus tuition

Household incomes have gone stagnant for nearly a generation. We all know that inequality is rising to a level last seen in the Gilded Age. To show how out of control college costs have become, take a look at incomes in comparison to tuition:

Even the top 1 percent of households that have captured most of the income gains in the last generation have a slower growth rate than that of college tuition. Of course, if you look at the above chart the regular working family is running the infamous Red Queen’s Race. Run faster and faster to stay in the same place.

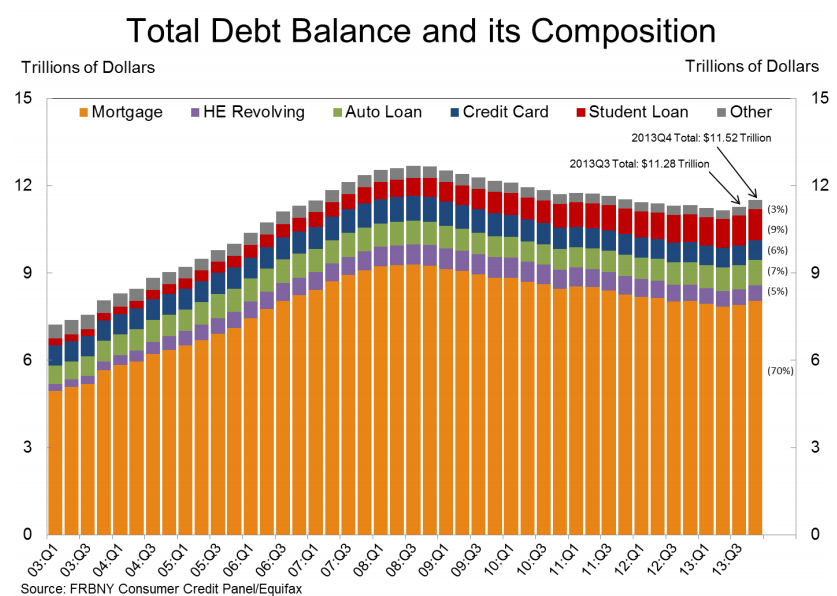

Largest non-housing debt sector

It is no surprise that student debt is now the largest consumer debt sector outside of mortgage debt:

Student debt as measured in the Fed’s report is at $1.08 trillion. More recent data suggests total student debt is well above $1.2 trillion. Keep in mind over the last decade this segment of debt has grown by nearly $1 trillion.

In other words, most of the student debt is on the backs of recent graduates. When we see all the reports showing that college graduates make more than non-graduates it is usually measuring data from a time when college costs were low and open jobs paid better. Will this paradigm make sense in a market where many jobs are paying $8 to $12 an hour and going to a private college costs $50,000 per year? The median household income in the US is $50,000 per year!

It is interesting to note that the amount of student debt is also impacting home buying. Many recent graduates are carrying student debt that mimics a mortgage. College is worth a certain amount of debt. This is such an important point and this isn’t meant to make debt seem like the nucleus of evil. However at a certain point you need to rethink how much debt a society can truly carry. You want young Americans to understand net present value and future value when most can’t even calculate a ROI. Yet here we are allowing a large portion of our young to go into massive debt, a burden that will be carried for a lifetime.

There is no easy solution here. A good college education is a very valuable thing. Yet when costs get this out of hand, you do have to run the numbers. You also have to be realistic with what jobs are paying well in this market. If you are getting a degree with lower wage prospects then you should opt for a state school and be cautious on the debt. We have over 4,000 universities in the US. How many actually produce a good value to students? We can certainly agree that most for-profit schools operate as cash cows for federal loans and basically exist to make the owners rich. Career placement is a joke at these schools. You would be better off watching videos off the Khan Academy online for free.

Yet we continue to have a system that is addicted to debt and blindly is going forward by saddling a generation of young Americans with debt. You have to wonder if there is a reason why no basic finance or investing class is required for high school graduates on the cusp of entering college? Then again, maybe this is how you get people to pay to $25,000 to $50,000 a year for a college education by going into massive debt.

Source:

http://www.mybudget360.com/college-worth-costs-debt-college-tuition-and-student-debt-levels-value-of-education/

.jpg)

Post a Comment