Before making your final presidential candidate pick, be aware that it can have a direct impact on your wallet.

In the International Business Times, personal finance editor Lauren Lyons Cole explains how the tax plans of leading presidential candidates could have a "lasting impact on the American economy as well as your future paycheck," based on research from the nonpartisan Tax Policy Center.

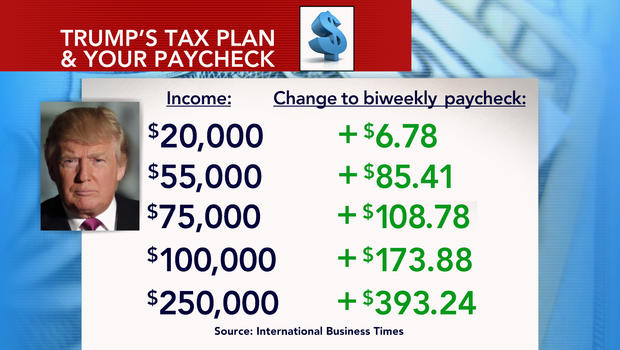

Perhaps the most surprising finding from Cole's research was that Donald Trump would put the most money back into your paycheck. The GOP front-runner proposes tax cuts across all income levels, and slashing taxes for those making up to $50,000.

"With Trump, of course, it's going to benefit the wealthy the most, so as you go up, your paycheck will increase drastically, which would benefit him as well," Cole explained on "CBS This Morning" Friday.

But this comes at a cost -- a $9.5 trillion federal deficit over the next decade, which would require drastic reductions in federal spending to help pay for the tax breaks.

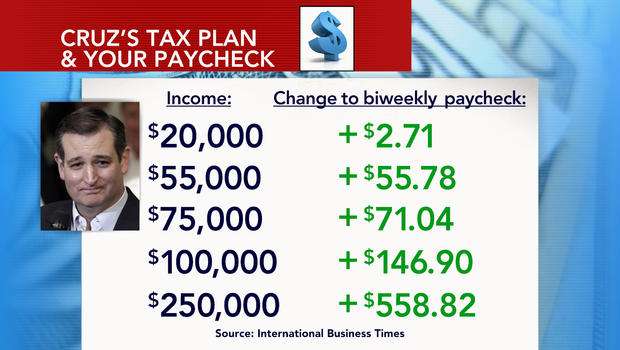

Republican rival Ted Cruz's tax plan would also result in an enormous federal deficit: an estimated $8.6 trillion over the next decade. Cruz's plan is the "most creative," Cole said, and would reform the current 750,000-page tax code for a flat tax rate of 10 percent across all incomes.

Cruz's plan would also benefit the wealthy most, even more so than Trump's, Cole said. As for the middle class, paychecks may increase by about 50 dollars, according to the International Business Times analysis.

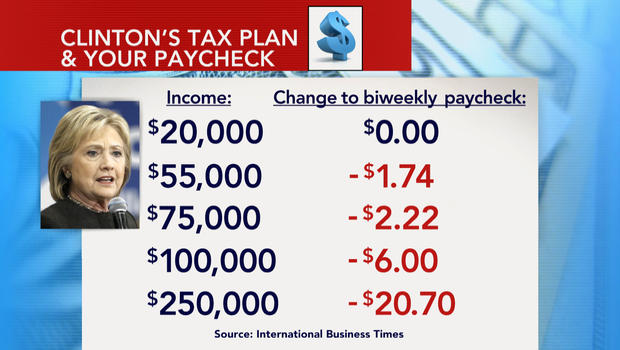

On the Democratic side, Bernie Sanders would also raise the federal deficit with his tax plan, which Cole said was "more extreme" than Trump's. The senator vows to raise taxes regardless of your income, with the highest earners paying over 40 percent, for a "trade off" for funding free government programs, including college and health care.

"Unless you need health care, then Bernie Sanders is not going to do a lot for you," Cole said.

Source:

http://www.cbsnews.com/news/2016-race-donald-trump-ted-cruz-hillary-clinton-bernie-sanders-tax-plans-impact/

No comments:

Post a Comment