Susan Duclos and Stefan Stanford recently interviewed “V” the Guerrilla Economist and the following information was revealed in this landmark interview:

“The process of undermining the US dollar is well on schedule as well; more than 105 countries have decided that the dollar no longer works for them, joining Russia, China and other BRICS nations in leaving the dollar as the entire world comes to the realization that America’s leaders are insane. Their recklessness and evil ways have left tremendous shame upon our nation. Though there has been much manipulation and propping up, but that is only setting us up for the inevitable massive crash.“V” begins by updating us on recent information that he has received from his 4-Star General source and warns that events are still on schedule, a schedule that he previously warned would leave the US dollar ‘undermined’ by 2015 and the US ceasing to exist as a nation by 2017“.

The interview can be accessed through the following link. I highly recommend listening to this interview.

On the surface, these claims appear to border on hysteria. However, as history has proven, time and time again, that Susan Duclos, Stefan Stanford and “V” are to always be taken seriously when revealing controversial information.

Subsequently, I proceeded to find confirming, or disconfirming evidence, that these claims are accurate and should taken seriously by all Americans. Both the direct and ancillary evidence serves as overwhelming in support of V’s claims and Susan’s reporting.

Halfway to Economic Armageddon

“V’s” claims notwithstanding, the American economy is already in severe danger as we consider the following facts.

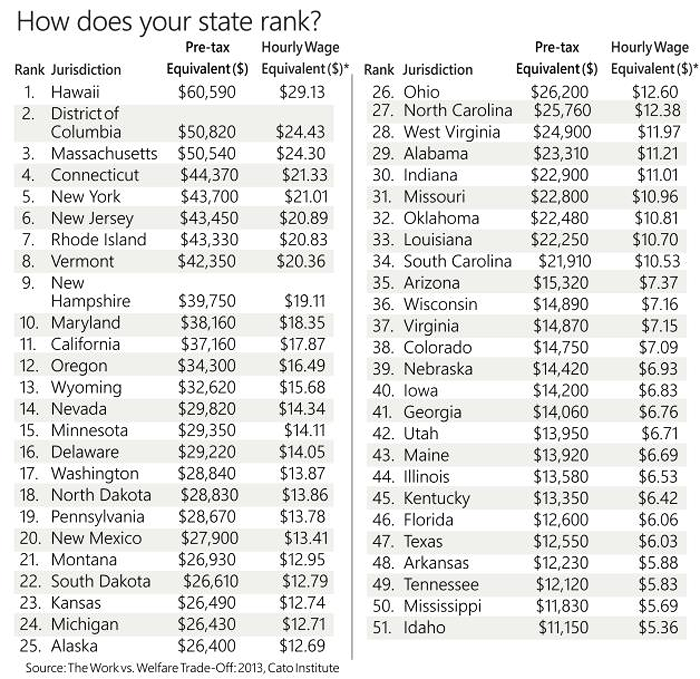

There are 35 states in this country in which it is better to accept welfare than work at an entry level job. Much like crack cocaine or heroin addicts, much of our nation is hopelessly addicted to living in the welfare state or on unsustainable levels of credit.

From a micro perspective, the personal economic health of America is abysmal. According to the U.S. Census Bureau, more than 146 million Americans are either “poor” or “low income”. Stunningly, more than 100 million Americans are enrolled in at least one welfare program run by the federal government, not including the massive entitlement programs of Social Security or Medicare. The number of people on food stamps has grown to 47.79 million Americans. In 2008, when Obama first took office, only 32 million Americans were on food stamps. Approximately, 20.2 million Americans spend more than half of their incomes on housing, which represents a 46% increase from 2001. Parents under the age of 30 experience poverty rates consisting of 37 percent. The number of Americans living in poverty has grown to one out of every six US citizens.

The above information could be considered to be the good news. What follows is grim.

Watch the Credit Swap Derivatives

In the United States, credit swap derivatives created national debt totals of over one quadrillion dollars. That is one thousand trillion dollars! The entire GDP of the planet is estimated at $66 trillion dollars. And somehow, in the infinite wisdom of Congress in 2008, we falsely and naively believed that a $750 billion transfer of wealth (i.e., Bailout #1) was magically going to save the economy and the collective futures of the American middle class. Please let me repeat that the most conservative estimate is that the derivatives debt is 10 times greater than the GDP of the entire world. Most economists estimate the number to be 16 times greater that the GDP of the planet!

In short, the debt created by futures speculation is approximately 10-16 times greater than the sum total of the entire wealth on the planet! It would not matter if the debt was only two times the GDP of the planet, we do not have the capacity to pay down this debt. The interest on the debt is growing faster than the rise in national revenue. And we think we are going to climb out of this? Let’s take a moment and discuss the derivatives debt.

Five of the “too big to fail” banks in the United States that have more than 40 trillion dollars in exposure to derivatives. The national debt is sitting at a grand total of almost 18 trillion dollars. The sum of 40 trillion dollars is almost unfathomable.

Credit swap derivatives trading is not too different from betting on baseball or football games. It is gambling, it is a Ponzi scheme and Wall Street bankers should be in jail. However, this is the new economic landscape of America. The name of the game is the “Last American Garage Sale” where these bankers are positioning to steal all the assets possible before the collapse.

Please note that under the category, in the above illustration, “Widgets “R” US Corp“, the banks loan the money. In other words, if this Ponzi scheme fails, the banks which underwrite and guarantee the entire process, will eventually fail!

The credit swap derivatives are bad enough, but when we carry over the economic implications to the health of the banking system, the banks are bordering on total collapse along with all of your saved earnings.

Most Americans Think That Their Deposits Are Safe

Some readers have written to me and have dutifully reminded me that the FDIC is at their bank standing guard over their deposits. How woefully and depressingly ignorant is that statement?

The FDIC does not have the money to cover your deposits as it has only $25 billion in its deposit insurance fund. By law, the FDIC is required to keep a balance equivalent to only 1.15% of insured deposits on hand. Yes, America, that means that less than 2% of your deposits are covered.

Others have pointed out to me that the Dodd-Frank Act (Section 716) now bans taxpayer bailouts of most speculative derivatives activities. You remember the derivatives don’t you? They were the imaginary wealth that was built upon more imaginary wealth but were guaranteed with hard assets backed by the banks. When this house of cards collapsed, it pulled the banks down and led to the series of bailouts which has devastated our economy.

Therefore, when your bank defaults, and it will, the depositors as well as the banks will turn to the FDIC for relief. The FDIC will have no choice but to draw upon its credit line in order to cover a BofA, Wells Fargo and JP Morgan derivatives bust which has been co-mingled with savings account funds. The resulting effect is that this will require a taxpayer bailout to cover the credit line.This will negate the safety from the bailouts that the public thought that they were receiving under the Dodd-Franks bill of no more bailouts.

What very few people are talking about, and as is the case with all credit lines, this money will have to be paid back. Therefore, the coming default of the FDIC, used to cover the derivatives debt, will become the excuse for another taxpayer bailout. And on and on it goes.

When the last instrument has been looted and then deflated, where do you think that will leave you and your computerized digits that represent the bulk of your self-built financial empire? All of your life, most of you have worked for banker backed interest in some capacity and now, these banksters are stealing back the pittance they paid you in the first place. Where’s Karl Marx when you need him? Bank depositors of the world, unite!

More Bad News

With the banks in debt to the tune of $40 trillion dollars, the pension system is also at risk because the banks and their related financial investment firms underwrote the Credit Swap Derivatives. Moody’s warns in its latest report on the state of public pension systems. As Bloomberg reports, “The 25 biggest systems by assets averaged a 7.45% return from 2004 to 2013, but liabilities tripled over the same period leaving them facing a $2 trillion shortfall as investment returns can’t keep up with ballooning obligations”. The top 25 funds account for 40% of the entire US public pension system. Bloomberg further reports that “The 25 largest U.S. public pensions face about $2 trillion in unfunded liabilities, showing that investment returns can’t keep up with ballooning obligations”, according to Moody’s Investors Service. Americans will be working until they drop dead because, very soon, there will be no such thing as a pension. Very soon, most of these Americans will not have any job to go to.

When this house of cards comes crashing down, how do you think the government will deal with the situation? If you have not listened to V’s interview, I would suggest you do so now.

Source:

http://www.thecommonsenseshow.com/2014/09/27/the-collapse-of-the-american-economy-has-begun/

No comments:

Post a Comment